Source : RockHealth, KPMG, CBInsights

BB Comments : In a year when everyone expected funding to decline, digital health has been as steady as ever and accounted for a healthy 8% of total venture funding. Beside that the first half of 2016 came out with a record-breaking 151 companies which raised more than $2M.

Rock Health reported just more than $2 billion in total venture funding – on track with the levels of both 2014 and 2015. While funding hasn’t continued to surge upwards as it has in the past, Rock Health analysts Mitchell Mom and Ashlee Adams write digital health funding is "hitting its stride."

Following two record years of digital health funding, they report, 2016 has started with a more moderate pace, with overall funding about $191 million below 2015’s first half record.

"While this number ($2B) didn’t eclipse either of the previous years’ numbers, it’s important to keep context," they write. "In a year when everyone expected funding to decline, digital health has been as steady as ever and accounted for a healthy 8 percent of total venture funding."

CB Insights, which is newer than Rock Health and tracks a much broader range of digital health companies, reported $3.5 billion in funding across 476 deals. Both noted a leveling off of funding in Q2. Both also track the top geographic region for funding as California, followed by New York.

As we’ve written before, it’s important to note that, generally, Rock Health’s process is a bit more conservative than most, as it only includes funding rounds that are more than $2 million, avoids conflating investment dollars with transactional costs associated with M&A, and has a stricter definition of a digital health company than either CB Insights or StartUp Health, whose midyear funding we reported earlier this month.

While the dollars might be leveling off, the sheer number of companies receiving funding at an all-time high, Rock Health reports, with 151 companies raising more than $2 million.

Rock Health reports the average deal size for 2016 at $13.3 million. While the first quarter saw larger rounds (deals averaging at $15.4 million), the leveling off during Q2 brought the overall midyear average down quite a few pegs. The largest deal thus far has been Flatiron Health, in a $175 million round led by Roche.

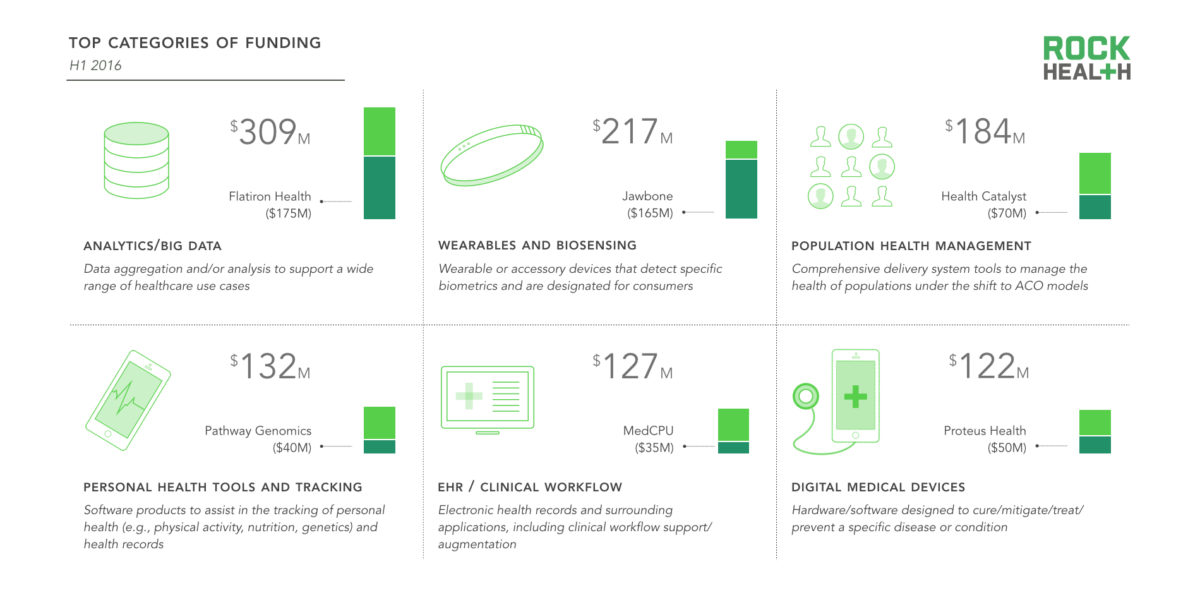

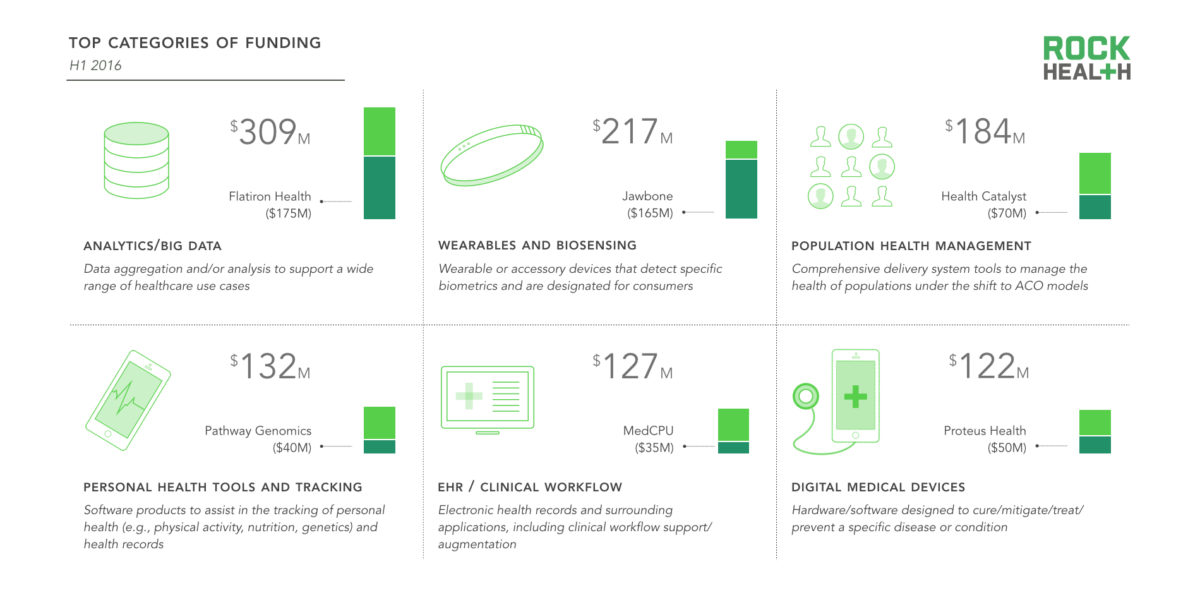

The top six categories of the year that received 54 percent of all funding were analytics/big data with over $300 million in funding (Flatiron alone accounted for more than half of that with $175 million); wearables and biosensing at $217 million (Jawbone making up $165 million of that); population health and management at $184 million; personal health tools at $132 million; EHR/clinical workflow at $127 million; and digital health devices with $122 million.

Rock Health noted that the consumer space also continues to receive consistent investor attention, with two of the top three digital health "unicorns" -- 23andMe and ZocDoc -- being consumer-focused companies. Rock Health sees consumerazition as an area ripe for "disruption by digital health startups," thanks to the fact that over one-third of adults are now convered under high deductible health plans, a shift in coverage that transfers more of the burden to the consumer. While healthcare consumer engagement still didn’t make the top six, it did experience year-over-year growth of 127 percent.

Two hundred and forty-eight distinct investors funded digital health companies in 2016, according to Rock Health’s definition. Most active venture investors for 2016 have been a mix of new and old, with corporate investors outpacing traditional venture funds in the number of deals. Top venture investors were Khosla Ventures, Jump Capital, Norwest Venture Partners, Pritzer Group, Safeguard Scientifics and Jump Capital. UPMC, Heritage Group, Blue Cross Blue Shield and Merck topped out the corporate most-active list.

As has been the trend for the past two years, Seed and Series A stage deals represent most of the deal volume, and later stage deals account for a little more than a fifth of all deals.

Looking at exits, Rock Health reported 2016 has also been slower in public markets than previous years, with NantHealth's $1.5 billion offering accounting for the only IPO. Overall, IPO performance hasn’t kept pace with funding, with nearly all public companies trading below their initial share price.

Halfway through the year, 87 mergers and acquisition deals have already been closed (slightly below 2015’s midyear mark), with total disclosed dollars eclipsing $10 billion.

As Rock Health analysts say, "Stay tuned to find out if this year will become the new normal or if we’re still waiting for the proverbial shoe to drop."

Keine Kommentare:

Kommentar veröffentlichen